Effective decision-making, disrupting experiences and the challenges of building a brand: lessons from Carvana's CEO

💡JC's Newsletter #106

Dear friends,

In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate.

I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those.

If you are not subscribed yet, it's right here!

If you like it, please share about it on social networks!

💡 Must-read

👉 Ernie Garcia (Carvana) - Disrupting the Auto Buying Experience (Join Colossus)

You need to make sure that big foundational conviction decisions are really good. What market are you going after? Why are you going after that market? How are you going to approach it? What's centrally important to you? What things will you trade off on? What will you not trade off on? What are your principles and values and things that you're going to adhere to through thick and thin regardless of what direction maybe numbers might be pointing you in the moment?

➡️ Answering those questions is really powerful. Especially the ones on “what you are not going to make a trade-off on even if the early numbers point you in the other direction”. It is extremely hard to build that level of conviction.

We have these pillars of a great experience, great price, and a broad selection.

When we launched, we had like 40 cars on the website, it was no different than going to your local dealer. We were able to offer lower prices because especially at the volume of 40, it doesn't really matter what your price is, you're going to lose a ton of money anyway for trying to build a digital platform.

➡️ I love the idea of getting to scale as fast as possible, even if insurance is very different, and we want balanced contracts.

Building a brand is hard (...) Having a symbol that reflects what you are, and sometimes having that symbol just be cool and fun, awesome.

We just tested this idea of having customers come pick up from us. And we did this in Atlanta, it was our first vending machine. And really all it was, it was a couple of glass garage door bays.

Let's call this the car “vending machine.”

We didn't have a lot of press coverage early on. And so we would do anything to try to get some press coverage. All we wanted was a little bit of free advertising.

Once you build something awesome, people want to go have that experience and you do save last mile expenses and that works out. Then you also have this symbol that helps you to build your brand.

➡️ How we can think about physical spaces for Alan?

And I think that trying to creatively solve that equation where you're doing things that get people's attention, but you're doing it in ways that allow you to tell your stories that you can build from no awareness whatsoever to awareness, to understanding and trust. That's a really, really hard thing to do. And I think at first, we started by just trying to say like, "Of course, people care about us because we care about us, so let's tell our full story." And we didn't pay them for their attention. And I think that was a big mistake.

You have to be super clever about grabbing a little bit of attention and then trying to send your messages as effectively as you can.

➡️ Good marketing lesson.

🏯 Building a company

👉Arjun Murti - Exxon Mobil: An Aging Energy Empire (JoinColossus)

So Exxon is what is called an integrated oil. [...] They explore for and find oil. They go out and get leases, they drill wells and get the oil out of the ground.

They’ll take that raw crude oil and turn it into a usable product that we actually want. [...] they deliver it ultimately to the customer.

Through gas stations as the marketing business, corresponding outlets for trucks and airline business and so forth. They also though take some of those feed stocks and turn them into petrochemicals, ethylene, polyethylene.

By large, oil companies don't actually own their gas stations anymore, they tend to get franchised out.

And what he had the visionary insight to do was, if I control the logistical infrastructure, I can control the price of oil. And so he essentially monopolized the pipeline and refining part of the business.

And by controlling and being the monopoly owner of that infrastructure, he was able to shut people off. He was able to limit how much supply made it to market and therefore defacto control the price of oil and ensure that he and frankly everybody else for that matter would earn an acceptable level of profits.

➡️ Interesting history of the oil industry, how to consolidate power, the importance of vertical integration, and to find the place where you should own the “infrastructure”. Also a good lesson on how not to abuse your power, and forget your member obsession.

CEOs and management teams, one of their number one responsibilities is to train and mentor and bring along that next generation.

➡️ Very important lesson!

👉 Brain Food: Saying Yes, Maps, and Getting People on Your Side (Newsletterest)

“Most people implicitly assume that their “map” of reality is supposed to be already correct. If they have to make any changes to it, that’s a sign that they messed up somewhere along the way. Scouts have the opposite assumption. We all start out with wildly incorrect maps, and over time, as we get more information, we make them somewhat more accurate. Revising your map is a sign you’re doing things right."- Julia Galef in The Scout Mindset

🗞 In the news

📱Technology

👉 Existential Optimism (Not Boring)

Microsoft’s Work Trend Index found that 40% of Americans are considering quitting their jobs this year.

PWC’s Next In Work put the number higher -- 65% of employees they surveyed were looking for a new job; 88% of executives said that turnover was higher than usual.

In July, 4 million Americans, 2.7% of the workforce, quit their jobs.

➡️ That is why you should use Alan Mind :)

👉 Crypto Bezos (Not Boring)

I don’t think Bezos would just start a web3 company to start a web3 company. Crypto would be a means, not an end. He’d start something that took advantage of web3’s unique capabilities to better serve customers.

But even five years into its life, when it [Amazon] was worth $30 billion, the media dismissed it as almost a joke, an overhyped and overvalued futuristic oddity thingamajigger.

In crypto, the customers can also be the owners from the earliest days. He might raise money directly from customers instead of (or in addition to) outside investors, or let customers become owners just by being customers. Better alignment, built in.

The next thing Crypto Bezos would notice is that web3 lets companies bootstrap early demand without spending a ton of money on marketing. Incentivized customer / owners will spread the word to other customer owners.

Crypto Bezos might build his own blockchain from scratch, and the apps on top, if it meant better serving customers (and more value accruing to his token).

👉 Thread by PimDeWitte “Having spend a decent amount of time in blockchain... “ (Ping Thread)

I believe the majority of play-to-earn games are not sustainable. If you took away the earn part, retention would drop to low levels.

When gameplay is tied to rewards, automation and botting will eventually outpace regular play, which will lead to unhealthy communities (i.e. see what happened to RuneScape).

Instead, I believe we will first see regular games that have simple NFT/Crypto elements implemented. Card games with real ownership (i.e. Pokémon cards) and skill-based games that are implementing NFTs skins, but where gameplay isn't tied to monetary rewards.

👉 Lithic's New Customer (Not Boring)

Turns out, their unique needs weren’t that unique. Scores of modern fintech companies were also looking for a more flexible and modular card issuing API.

Last year, after a year of beta testing, Privacy.com launched its own Card Issuing API, making the issuing infrastructure it built for itself available to anyone.

Lithic’s Card Issuing API took the primitives that the company built internally -- issuing, processing, spend controls, just-in-time funding, auth stream access - and lets customers mix and match what they need, when they need with modularized components that they can get elsewhere, like sponsor banks, ledgers, card manufacturers, or KYC tools.

Lithic’s structure is incredibly flexible. Lithic’s beauty is in its modularity.

➡️ I like the modularity of Lithic.

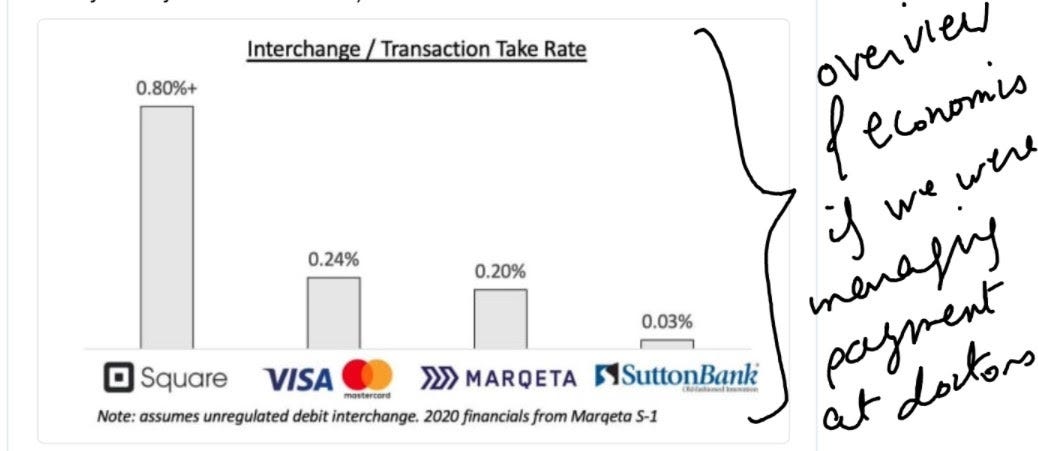

➡️ I also found it interesting that Marqueta has issued options in Marqeta to some of its customers, pending usage milestones being hit.

Square has warrants of 1.1m shares (worth $40m)

Uber has warrants of 750k shares (worth $26m)

Ramp has warrants of 50k shares (worth $2m)

🏥 Healthcare

👉 Microsoft’s million-tonne CO2-removal purchase — lessons for net zero (Nature.com)

What Microsoft and Stripe are doing:

In January this year, Microsoft made a major announcement: it had paid for the removal of 1.3 million tonnes of carbon dioxide from the atmosphere.

By 2030, the company will reduce its emissions by half or more, and will have 100% of its electricity consumption matched by zero-carbon energy purchases.

The firm is levying an internal carbon tax across all types of greenhouse-gas emission.

the $9-million purchases of carbon removal in 2020 and 2021 by the US–Irish financial-infrastructure company Stripe.

Bugs of the system:

We highlight three ‘bugs’ in the current system: inconsistent definitions of net zero, poor measurement and accounting of carbon, and an immature market in CO2 removal and off-sets.

Stripe’s 47 carbon-removal proposals amounted to 16 MtCO2, but only 0.024 MtCO2 met the company’s requirement that carbon remain sequestered for at least 1,000 years.

Roughly one-fifth of proposals to Microsoft focused on avoiding new emissions, not on withdrawing CO2 from the atmosphere; these were rejected.

There’s no standard way to measure, report and verify carbon removed.

Three priorities:

Businesses have lots of options. For example, offsetting emissions — by paying someone else not to emit as a way to compensate for ongoing emissions — can slow the rate at which CO2 builds up in the atmosphere, but it does not remove any. That’s why, in 2020, Microsoft pivoted to purchasing only carbon removal.

What can be done? Companies should start by reducing to zero those emissions they have most control over, such as from energy use and land management.

The non-profit organization Greenhouse Gas Protocol provides guidelines for assessing emissions from internal operations, such as vehicle use and manufacturing, and from purchases of energy sourced off-site. Estimating emissions from supply and value chains is more difficult.

Three-quarters of Microsoft’s emissions come from these, including building materials, business travel, product life cycles and the electricity that customers consume when using Microsoft’s products. The company has been using expenditure data and industry-average emissions for reporting purposes. But these have large uncertainties and are of limited use in reducing emissions in practice.

➡️ How would you like us to work on environment x health? I feel it is very important to connect the two, and I’d love the feedback from the community.

👉 Soda Health launches to tackle health inequities by paying for food, OTC meds (MobilHealthNews)

To reduce health inequalities by creating a technology framework that allows health plans to reimburse for goods and services not supported by traditional medical claims.

The company’s offering gives consumers health plan debit cards to purchase items related to the social determinants of health, such as healthy foods, over-the-counter medications and transportation services.

👉 Apple Health (insider)

After a string of departures in Apple’s healthcare division, former employees say the group has no clear direction and has struggled to integrate its hardware business with the medical profession. A resignation letter from a doctor who left in 2019 said Apple has been quick to fire people who raise concerns.

👉 Canvas: A Bet On New EMRs (Out-Of-Pocket)

The first is its “narrative charting” user experience. It’s sort of like the Gmail auto-complete feature on steroids and actually useful because it understands when to end phrases with exclamation points and when not to in order to avoid sounding passive-aggressive but not too excited.

➡️ Implementing this in our medical chat could be super interesting.

The other way Canvas speeds things up is by creating programmable commands that fit into a phrase. For example, you could program a phrase like “AWV” for a patient’s annual wellness visit and it would check to see which tests need to be run, automatically set up the order forms, create the questionnaires that need answers, and automatically generate a care plan that gets sent to the patient.

➡️ For our medical chat too. Super interesting.

Specialty Telehealth: Now that people are realizing modern specialty groups will be a combination of in-person and virtual care delivery, there are lots of new specialty Telehealth startups popping up. These groups can build all of the patient- facing pieces that they consider a differentiator while outsourcing the provider- facing and back-office software to Canvas (scheduling, patient payment, medical record management, etc.).

➡️ Maybe one day we will give access to our software to other companies.

💚 Alan

👉 🇫🇷 🐓 Alan is part of the Next 40 for the 4th time in a Row (Twitter, LinkedIn)

We are extremely proud and humbled to have been selected alongside our friends at Contentsquare, Lydia, Qonto, Swile, PayFit France …

This distinction motivates us to go continue working relentlessly to develop THE super-app making physical and mental health simple and accessible for everyone 🤗

Want to join the adventure? We recruit exceptional talents in Sales, Engineers, HR, Design, Insurance, Marketing, Legal, Operations, ... Take a look at our job openings!

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇

Let’s talk about this together on LinkedIn or on Twitter. Have a good week!