Bonjour,

Chaque semaine, je partage quelques articles que j’ai trouvés particulièrement enrichissants. J’espère qu’ils vous aideront autant qu’ils m’ont aidé.

Cette semaine (entre autres) :

Pinduoduo et l’e-commerce social

Transferwise, ou comment grandir de 60 à 1 000 personnes

Amazon et la Santé : pas si simple

Je me lance sur Instagram !

Certains articles sont en français, la plupart sont en anglais (je copie certaines citations en anglais). Ils ne sont pas tous récents et vont au rythme de mes lectures.

Bonne lecture !

Si vous aimez, vous pouvez vous inscrire, partager ou encore me suivre sur Twitter.

📱Monde des technologies

👉 Pinduoduo et l’e-commerce social, verticalement intégré. Fascinant de comprendre leur modèle (Turner Novak)

In 2015, Colin Huang founded his third company, Pinduoduo (PDD). By June of 2020, it had become China’s second largest ecommerce company and was valued at over $100 billion in the public markets.

In 2006, Duan won the annual charity auction for lunch with Warren Buffett with a $620k bid. Colin joined alongside Duan’s wife and five other friends. It's said that this meeting with Buffett greatly influenced Colin’s crafting of the Pinduoduo business model. This included the power of simplicity, utilizing float, and redistributing wealth.

Colin returned to China shortly after to work on a secret team launching Google China. He reportedly grew tired of constantly flying back and forth to the US pitching Google founders Larry and Sergey on trivial matters.

Colin came up with the idea for what became Pinduoduo by observing China’s two largest internet giants: Alibaba (ecommerce) and Tencent (social, games). (...) Pinduoduo fell directly in the center of the two; social gamified ecommerce.

PHH’s initial business model consisted of buying fruit in bulk from farmers and then selling it directly to consumers.

Pinhaohuo’s business grew entirely through group chats on Tencent’s popular WeChat.

By September of 2015, Pinhaohuo had became China’s #1 free app.

Pinhaohuo quickly automated the warehouses to intake, sort, package, and distribute inventory onto trucks to be shipped out. Within a month, most fruit spent only a few hours in any of PHH’s six fulfillment centers.

By the end of 2015, 10 million registered users were placing 1 million orders per day. Customer retention was 77%. Half the orders were still coming directly from WeChat.

In 2016, Pinhaohuo merged with another company Colin had built, a game-like ecommerce platform called Pinduoduo. (...) By Q1 of 2017, the combined entity had completely wounded down its operationally intensive direct sales model in lieu of an asset light marketplace. PDD took a 0.6% cut of all sales, or enough to cover payment processing costs. The majority of its revenue would eventually be generated from in-app ads purchased by merchants, as described later.

Failed competitors mostly had their own apps or websites; PDD was built entirely on top of WeChat

Une histoire de croissance extraordinaire :

In the early days, the app often had no more than 20 SKU’s at any one time. This allowed it to focus on a few core products while incumbents worried about customizing a long-tail of listings.

Without an endless stream of search results, PDD’s users had a constrained choice. It also gave more accurate data on user behavior and interests that fed back into its algorithm to target users later.

Like a traditional social company, Pinduoduo started predicting what users might buy. (...) And its algorithm could push deals, not specific items.

PDD’s feed-based interface placed more exposure on single products. This gave it full control over distribution to influence consumer purchase decisions in ways most favorable to PDD and its suppliers’. This was similar to how TikTok helped new creators quickly build social capital and earn fans: TikTok could deliberately control the allocation of social capital to its most talented creators, both new or old, as new users poured into the app.

WeChat then launched its now popular Mini Programs in 2017. This allowed developers to build pared down apps (often less than 1 MB) that lived inside of WeChat. Many developers experimented with apps that complemented their existing products, but for PDD it offered a more sophisticated extension of the native distribution channel it built on top of WeChat.

GMV continued doubling every quarter and passed RMB100 billion, or ~$14.7 billion by the end of 2017, less than three years after it was founded.

When Pinduoduo submitted its filings to go public in 2018, many were surprised it described itself as “Costco meets Disneyland”.

Gamification du e-commerce :

It explains why the initial PDD concept took off so fast - it was really just a game.

The deals on Pinduoduo changed every day. The app had colorful photos and discounts were hidden everywhere. There was a wheel to spin for daily coupons, discounts for sharing invite links with friends, free products in exchange for reviews, and rewards for daily check-ins similar to Snapchat’s streaks.

There was even a leaderboard showing who had saved the most money.

In May of 2018, Pinduoduo launched Duo Duo Orchard. It was a game to grow virtual trees inside the app. The more purchases, actions with friends, and time spent in-app, the faster the trees grew. When the trees were fully grown, the player was shipped a box of fruit. It was a virtual stamp card.

Comment financer la croissance :

For a company like PDD that might see its business grow 25-100% in any given month, receiving cash up front from consumers and paying its bills two weeks later had massive downstream implications on its capital needs. This negative working capital provided excess cash to subsidize user acquisition and allowed the company to mitigate shareholder dilution as it scaled.

The app had 488 million MAU’s, with many still accessing its services solely through WeChat.

PDD’s marketplace model kept costs flat as incremental revenue on larger orders fell to the bottom line. These new users also aggressively invited their friends. This meant that, while paying similar ad prices, PDD’s ROI was almost always higher than its competitors. It consistently spends almost all of (and sometimes more than) its reported revenue in a quarter on marketing. This is essentially PDD using the two week float provided by the 5.1 million merchants in Q4 of 2019 (up from 1 million in 2018) to acquire customers before paying them out.

Live streaming :

In 2019, it began heavily emphasizing live streaming. Analysts project China’s live stream market will generate $136 billion in transactions in 2020, up 121% from 2019.

PDD’s recently launched online pharmacy sells both OTC drugs and medical devices. It’s a market fraught with inefficient middle men and pharmaceuticals represent a recurring, sticky product like fruit.

🏯Construire une entreprise

👉 Transferwise : grandir de 60 à 1000 personnes, et quelques conseils d’organisation (Mind the product)

Personally I define someone as “onboarded” when they’ve understood what matters to our customers and how to “get stuff done” at TransferWise. In my experience very few people can “onboard” themselves. During a person’s first few month’s in TransferWise, their lead should take an active role in defining clear tasks and objectives that help them figure out what matters to customers and how to execute at TransferWise. As the individual is “onboarded”, good leads empower them as they build context.

One of the biggest misconceptions about autonomous teams is that we have autonomous individuals here at TransferWise. We don’t. (...) The team has a clearly defined mandate, and is responsible for setting plans in its area. Teams set plans – not individuals.

The team, not the lead, owns the strategy and KPIs. (...) Strategy is devolved to the lowest part of the organisation that it can be by default. For example our liquidity team owns where our cash should be deployed – not our Finance Director.

Our teams are self sufficient. They have all the resources within the team they need in order to have an impact – e.g. marketing teams have engineers within them, or product teams have designers. This single change has probably given us the greatest driver of our speed.

We’ve done remarkably well at working with constraints that run across the organisation. For example we’ve operated without a CMO, and don’t have central allocation of a marketing budget. Our marketing teams have defined their pay back period, and challenge and support each other across teams.

Team’s rarely shut themselves down and admit failure. They also take too long to do this “autonomously”. Frequently (but not always), this needs some form of “management intervention”. When it comes to failure, the team, or indeed ego, can matter more than customers.

👉 Comment fonctionne le conformisme et pourquoi il faut l’éviter (Paul Graham)

When the conventional-minded get the upper hand, they always say it's in the service of a greater good. It just happens to be a different, incompatible greater good each time.

There are two reasons why we need to be able to discuss even "bad" ideas.

The first is that any process for deciding which ideas to ban is bound to make mistakes. (...) So instead of getting the margin for error we need, we get the opposite: a race to the bottom in which any idea that seems at all bannable ends up being banned.

The second reason it's dangerous to ban the discussion of ideas is that ideas are more closely related than they look. (...) The best ideas do exactly that: they have consequences in fields far removed from their origins.

🏥 Santé

👉 La percée d’Amazon dans la santé ne se passe pas aussi bien que prévue pour l’instant (The Information)

Executives from Amazon, Berkshire and Chase, all three of which are represented on the Haven board, were particularly frustrated by the venture’s lack of progress on a key data platform project during Gawande’s two-year tenure as CEO, according to the person. The project aimed to use aggregated claims data from the founding companies’ employees to glean cost-saving insights.

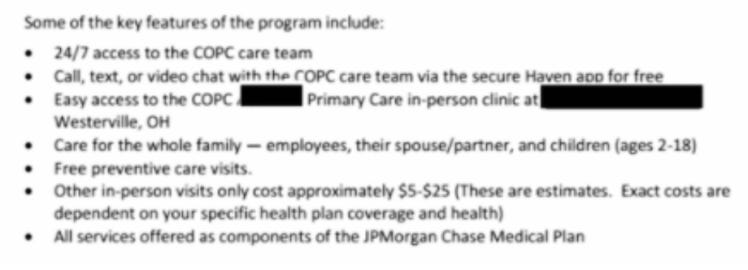

The program would use technology to connect patients to a dedicated primary care team that knew their medical histories, these people said.

JPMorgan Chase and Haven share the hope that by creating easier, 24/7 access to a dedicated primary care team, patients will be able to avoid unnecessary (and more expensive) ER or urgent care visits.”

One such project aimed to use aggregated health claims data from many of the founding companies’ combined 1.2 million employees to produce insights that could save money. But employees say obtaining, securing and parsing the data—much less drawing useful insights from it—proved to be much more difficult and time-consuming than Haven had expected.

Haven’s struggles became more apparent internally in the last week of April. In a virtual, all-company meeting, Gawande told employees Haven was shutting down the Starfield project after all and would also be laying off employees.

One current employee estimated that the cuts affected roughly 20% of Haven’s 70 some employees, many of whom had worked on Starfield. Others who had worked on the project were transferred to different teams.

💚 Les publications d’Alan et sur Alan

👉 21 inspirations pour penser ou repenser la culture d’entreprise (Blog Alan) : notre culture d’entreprise n’existerait pas sans l’apport inestimable de certaines personnes. Voici donc une liste de références à l’influence déterminante pour Alan.

📱 Je me lance sur Instagram (et on prépare la sortie de Healthy Business, petit teasing ci-dessous ..) !