Dear friends,

In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate.

I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those.

If you are not subscribed yet, it's right here!

If you like it, please share about it on social networks!

💡Must-read

👉 The Chief People Officer as PM: Rethinking The Systems & Tools That Run the Company (Review FirstRound)

Ask the team about:

How did you end up at the company?

Why did you stay?

➡️ Good questions for 1on1s.

Recognition:

As an alternative reward that better aligned with their values, the Credit Karma team introduced the annual Exceptional Impact Program. “You can nominate yourself or somebody else, and we give an additional equity grant to people who've really shown some sort of exceptional impact.”

Gamify recognition:

Zynga was much more extreme.

We did these quarterly awards and we intentionally designed them to drive after our values,”

“For example, there was a founder/CEO award, where the CEO Mark gave his Tesla to people for a quarter, back when Teslas were still brand-new. We had this Atlas award, which was all about the people who were holding up the company, so you got $5,000 to take time off and go travel somewhere.

➡️ Fun ideas about awards (even if not my favourite thing, and I don’t own a Tesla :p)

Talk about the hard stuff:

Attrition isn't necessarily bad. It's very healthy. But if you're not talking about it, people will assume the worst

➡️ About talking about attrition in an open way.

Staying on message:

You have to keep singing the same song over and over. Because people don't remember, and you have new people joining who haven't heard you sing that song,”

➡️ Counter intuitive but important.

You have to slow down to be consistent, stay on message and tell employees how they're going to define success.

Reframing career growth:

“The idea that you can just keep promoting, promoting and promoting sort of times out at some point.

Meeting new people, working in a new environment with new products is growth and development, but you have to keep framing that for folks,”

As a leader, you have to help people reframe their expectations around growth and decide for themselves where they're at in their own careers and what they're aspiring to do.

➡️ Very important we frame it like that for our coaches.

Three times a year, we go through this process we call peer perspectives

“It's perspectives not feedback — because that’s such a scary, loaded term.

➡️ I love the term. Should we replace “reviews”?

Reflection: What was the most meaningful observation that you've reflected on from your peer and or upward perspectives?

Learning: When you get these perspectives again in four to six months, which characteristics do you want folks to recognise as improvements? Or what strengths do you want to continue to leverage?

Action: What actions and support do you need and do you want between now and the next cycle to make this a reality?

➡️ Add these questions to the review meeting?

🏯 Building a company

👉 Salesforce: Business Breakdowns Research (Join Colossus)

90% of the Fortune 500 use Salesforce

➡️ How do we reach that?

1/1/1 model: A philanthropic model coined by Marc Benioff. It is based on companies contributing 1% of equity, 1% of its product and 1% of employee hours back to the community.

➡️ I like the 1% of its product very much. The 1% of equity could go with our member tokens.

2005: Launch of AppExchange; an e-commerce site offering third party developers a place to work on their own applications and open them up to Salesforce customers. Forbes describes it as the “the iTunes of business software”

➡️ Interesting case study for mini-app platform.

Distribution: Salesforce sells through four main distribution channels:

Direct Sales - Telephone sales personnel & field sales personnel based in territories close to customers

Referrals/Indirect Sales - The company has a network of partners who are paid a fee based on the first year's subscription generated from the customer they referred. These partners include global consulting firms & systems integrators.

Marketing - Content marketing and engagement on social media channels, search engine marketing, customer testimonials, event sponsorships etc. As well as events like Dreamforce.

Strategic Investments - Salesforce invests in technology and professional cloud companies to support its key business and increase the capabilities of its platform. The primary objective is to increase the ecosystem of enterprise cloud companies and partners, accelerating the adoption of cloud technologies and creating the next generation of mobile applications and connected products.

➡️ Interesting about “strategic investments” and how to grow their ecosystem over time. Not for now.

Salesforce’s attrition rate was between 9% and 9.5% last year.

➡️ Interesting data point.

👉 Meta (Stratechery)

One of the things that I’ve found in building the company so far is that you can’t reduce everything to a business case upfront. I think a lot of times the biggest opportunity is you kind of just need to care about them and think that something is going to be awesome and have some conviction and build it.

Meta exists because Zuckerberg believes it needs to exist, and he is devoted to making the metaverse a reality;

➡️ How to have intuitions, believe in them, and test them vs. reality (in a cost effective way).

👉 Making financial services easy to code (a16z)

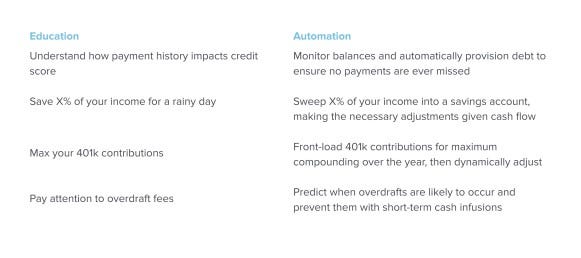

Consumers are not looking for financial education, they’re looking for better financial outcomes. And the strong form of this will be delivered via software automation, not education. Here are a couple of simple examples inspired by the famous “index card” approach to education:

➡️ How can we apply this framework to health and insurance?

🗞 In the news

📱Technology

👉 The Amazon Empire Strikes Back (Stratechery)

In the case of the trans-Pacific trade the key move was Amazon’s 2016 establishment of a freight-forwarding business. A freight-forwarder is basically a middleman in the supply chain which buys a guaranteed amount of space on ships, often via multi-year contracts at guaranteed rates with guaranteed space, and then re-sells that space to people who need it. This means that Amazon could, if they wanted to, make massive profits by reselling space they negotiated last year, but instead it appears that the company is offering space at cost to its resellers

➡️ Long term thinking.

In 2006 Amazon announced Fulfilment by Amazon, wherein 3rd-party merchants could use those fulfilment centers too. Their products would not only be listed on Amazon.com, they would also be held, packaged, and shipped by Amazon. In short, Amazon.com effectively bifurcated itself into a retail unit and a fulfilment unit…

Despite the fact that Amazon had effectively split itself in two in order to incorporate 3rd-party merchants, this division is barely noticeable to customers. They still go to Amazon.com, they still use the same shopping cart, they still get the boxes with the smile logo. Basically, Amazon has managed to incorporate 3rd-party merchants while still owning the entire experience from an end-user perspective.

➡️ Our approach with Alan as a Service: still owning the entire experience from an end-user perspective.

🏥 Healthcare

👉 Some crypto x healthcare ideas (Out-of-Pocket)

If you squint a little, this is a model for how a health record should work.

My health data is in a standard format and stored in my wallet.

Any third-party can connect to that data, build on top of it/deliver services using it, and can add to it. The data added goes to the record in your wallet, not the record that the company owns.

No company “owns” the data. You do - in your wallet. And you can give access to whoever wants it. As data gets added to your record, a longitudinal view of anyone that’s accessed or added to your data is in one place.

➡️ I don’t know if it is crypto, but indeed having a private wallet, encrypted, that you could connect to any website would be really powerful.

Insurance DAOs: Currently, a wave of decentralized insurance products are being built like Insurace or NexusMutual.

The company needs “minimum capital requirements” aka the minimum cash you need relative to claims you theoretically cover. This is something every insurance company needs and the amount is usually based on the company size + underlying risk of whatever you’re covering (health insurance has risk-based capital). NexusMutual’s model theoretically does this by issuing tokens that increase in price when there’s a lot of capital relative to claims, and decrease if the capital pool falls, theoretically incentivizing investment when the capital pool dries up. Underneath a certain ratio, it stops taking on new coverage until it meets the minimum capital requirement.

All the other functions are coordinated to members, third-parties, or automated and given token rewards for doing these tasks. The idea is that with more tokens at stake in this pool, there is less incentive to be a bad actor since it’ll tank your share of tokens as well. However...it also means that there’s a bit of a disincentive to pay out claims. This is the tension all insurers face, and is why it’s important to have an agreed upon + enforceable standard for payouts.

Or in fraud, waste, and abuse where lack of small scale audits amount to lots of lost dollars (maybe members of the insurance DAO can get bounties to identify fraud in payouts?).

➡️ Some interesting ideas.

👉 The skill of surgeons varies tremendously, with bottom quartile surgeons having over 4x as many complications as the best surgeons in the same hospital. (twitter)

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇

Let’s talk about this together on LinkedIn or on Twitter. Have a good week!