Virgin: big and bold brand bets, and the culture at tech giants enabling innovation

💡JC's Newsletter #108

Dear friends,

In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate.

I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those.

If you are not subscribed yet, it's right here!

If you like it, please share about it on social networks!

💡Must-read

👉 “The secret to big leaps” – Richard Branson (Master of Scale)

Saying "Screw it, let's do it" is how Richard has started many of Virgin's most legendary ventures.

You should never stop asking “What if?” and “Why not?” Take those daring notions seriously, and go all-in on the bold leaps. They will keep you innovating.

➡️ I love the appetite for risk and boldness.

I love going into new industries that I know little about. (...) I was 28 years old,

➡️ When he started an airline, so please let’s all be bold!

I think a lot of artists came to us because they knew that we were good at marketing. And we had a great team of people all under 20 years old, who had a lot of fun in their marketing campaigns, and didn't take themselves too seriously.

➡️ How can we be more pushy in marketing? Take more risks?

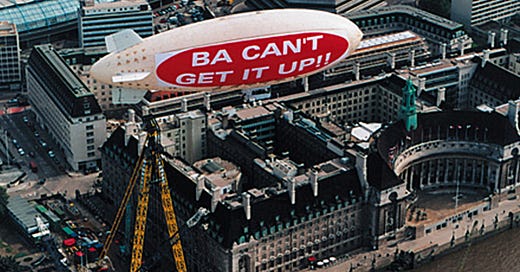

A particularly memorable one was in 1999 when the London Eye – the landmark 120-meter-diameter observation wheel – was being erected in the British capital. The event was being sponsored by British Airways.

BRANSON: I got a call at 5:00 AM one morning to be told that they couldn't get the wheel up. So we scrambled an airship, and it flew over the wheel and over a couple of hundred press, and photographers, and TV cameras waiting for it to go up. And the airship simply said, "BA can't get it up." And we got the headlines, and they didn't.

So I think it's just fun things where you pull the tail of the bigger competitor, and you do it hopefully to make people smile. It didn't necessarily make British Airways smile on some of these things. But anyway, it helped put Virgin on the map.

➡️ It is super funny. How can companies be playful like that?

We had our airship company filming the Superbowl for NBC. But they made it very clear that Superbowl advertising is the most expensive in the world, and that they couldn't put their cameras up on the “Fly Virgin Atlantic” logo on the side of the balloon. So we unfurled a banner outside the back of the airship, which said "NBC cameramen are the best looking guys in America." And we got lots and lots and lots of cameras coming up to the airship.

➡️ Really fun too!

Rather than diluting the brand, engaging in all of these different businesses has strengthened it.

➡️ Very interesting point about “brand”!

🏯 Building a company

👉 Robert Cantwell, Jesse Pujji - Facebook: The Trillion Dollar Listing (JoinColossus)

The bigger you are, the more data you have. The more data you have, the better targeting you can offer. The better targeting you can offer, the more effective your advertising. The more effective your advertising, the more share of ad budgets you're going to win.

➡️ Idea: Share the ad revenue with the User.

One of the first things was the frictionless-ness of their self-serve ad model. (...) Their ad platform works for anything. (...) They've invested more in their self-serve ad platform than any of their competitors.

Most people start with a sense of a budget, of how many dollars they want to spend. They don't start by thinking of CPMs. How much dollars can I spend and how many customers do I need for that to make sense for my business?

➡️ When you reduce friction, people come!

Rising CPMs are actually a positive signal at the marketplace that advertisers are finding value in the marketplace. Because they're consistently willing to pay more for a specific impression.

Google's a more straight forward auction.

There's a key word. They're willing to auction off the spot for it. It's called a second price auction, which means if I'm willing to pay a dollar and you're willing to pay 50 cents, I will pay 51 cents and I'll be above you. So I don't actually pay my bid. I pay one penny above the next highest bid. That's called a second price auction. Facebook has a different auction, which I won't go into all the dynamics called a VCG auction.

Where everyone displays their willingness to pay. And the auctioneer decides what the optimal outcome is for everybody in that situation.

So there's companies like Tube Science for example, where they said, "You know, the only thing that actually matters on Facebook is really good creatives”.

The way they get paid is, you get to determine how much of their creative you use and how much media you spend. And you only pay them for the stuff you're using against your media.

➡️ Interesting model, based on performance.

Most of these D2C brands and a lot of companies that are doing direct response, it's anywhere from 40 to 70% of its revenue comes from Facebook. And by the way, inside of their Facebook campaign, 60% of their scale comes from one ad creative that seems to be resonating in the marketplace.

➡️ Super interesting benchmark. I find it crazy high!

👉 Marc Andreessen - Making the Future (Join Colossus)

And the point is between basically, call it, 1945 and 1970, I don't know, one, or two, or three, the way new technology products got invented and developed was primarily not by a startup. It was primarily by a new division of HP, or a new division of IBM. And so literally, Bill and Dave at HP, I'll just focus on them, they would pick a high-performing, up-and-comer engineer, or product manager, or general manager, and they would basically anoint that person and say, "You go forth and build the laser printer," and then that person would create a new division inside HP and they would go and do that, and it would either work or it wouldn't, and if it worked, they would feed it money and resources and talent, and if it didn't work, they would wind it down and transfer those people to other projects.

And people would work for HP for their entire careers, but they would go from division to division. They would be in some divisions that were growing fast, they be in some divisions that were winding down, maybe starting divisions, so forth and so on.

These companies were famous for moving their high potential people from division to division.

And then, in each division, the division would own the product. They would own the future roadmap for the product. They would often have their own sales force, their own marketing campaign, they'd have their own HR internal division. They'd have their own finance internal division. And they actually would give the divisions quite a bit of autonomy.

And then, you'd have these general managers of the divisions who actually had a lot of control. They had a lot of control and autonomy over running the business. They had to report up to Bill and Dave, and they were expected to do a good job with the business and hit certain financial metrics and so forth. But they were like mini CEOs running their companies.

➡️ It is very connected with what we want to do with distributed ownership! Making it exciting to build wonderful and hard products at Alan!

🗞In the news

📱Technology

👉 The Apple v. Epic Decision (Stratechery)

Games are by far the biggest revenue drivers in the App Store (around 75% of revenue, and 98% of in-app purchases)

👉 Apple Makes the Rules, Reader and Productivity Apps, High-spending Gamers (Stratechery)

Importantly, spending on the consumer side is also primarily concentrated on a narrow subset of consumers: namely, exorbitantly high spending gamers. In the third quarter of 2017, high spenders, accounting for less than half a percent of all Apple accounts, spent a “vast majority of their spend in games via IAP” and generated 53.7% of all App Store billings for the quarter, paying in excess of $450 each.

High spenders, accounting for 1% of iOS gamers, generated 64% of game billings in the App Store, spending on average $2,694 annually; > Medium-high spenders, accounting for 3% of iOS gamers, generated 20% of game billings in the App Store, spending on average $373 annually; and > Medium spenders, accounting for 2% of iOS gamers, generated 4% of game billings in the App Store, spending on average $104 annually.

👉 Reddit’s Ad Revenue Expected to Double to at Least $350 Million This Year (The Information)

Pinterest, which had 454 million monthly users as of June 30.

Pinterest, by comparison, had about $1.1 billion in ad revenue just in the first half of this year.

Reddit faces obstacles to expanding its ad business that are typical of newer online firms. For one thing, some marketers see advertising on Reddit as experimental.

About 50% of Reddit’s audience is currently outside the U.S., but only 1% of the company’s ad revenues come in from overseas.

🏥 Healthcare

👉 BetterUp, a mental fitness/coaching platform for employees (the one that Prince Harry works for as Chief Impact Officer), raised $300 million at a $4.7 billion valuation (Link)

This funding comes only ten months after it raised $125 million at a $1.7 billion valuation. BetterUp reached $100 million in annual recurring revenue in July across 380 enterprise clients.

➡️ Should we have a Chief Impact Officer? Who would you like us to have?

👉 Personalized Health Insurance and the Payer Stack (Out-of-Pocket)

There are a few key advantages by creating more targeted insurance products. For one it becomes easier to target your marketing and potentially get word of mouth effects as beneficiaries refer others in their community who might have similar needs.

Clever Care for example is an MA plan that targets members who want more eastern medicine options. Humana was hiring a product manager to build plans targeting Korean and Chinese beneficiaries.

Going forward, [Alignment Health CEO John Kao] said the insurtech plans to unveil more health plans targeted at groups, like Hispanic and Black enrollees”.

➡️ How can we have more targeted products at Alan?

There has been an explosion of personalized primary care companies. There are primary care/care team companies focusing on demographics (e.g. Spora), sexual orientation (e.g. Folx), age (e.g. Iora), conditions (e.g. Thirty Madison) and more.

➡️ It would be great to study their positioning and understand better. Do we want to create a product for non-binaries for example? What would it look like?

Companies that do quality scoring of physicians like Garner Health can help identify high performance physicians in an area that might matter more for the target demographic you’re selling the plan to (e.g. if they’re more likely to have a certain procedure, then having that physician in- network is more important).

➡️ It would be interesting to check their product too.

Some of the newer TPAs that currently target the employer market like Flume Health might do this better + have a stack other payers can build on top of.

👉 Apple plans to add blood pressure monitoring and a thermometer to help with fertility planning in an upcoming version of its watch. The company continues to lean into health as the watch’s killer app.

👉 Menopause start-ups:

Healthtech startup Bia Care has appointed a chief menopause officer. Dr Juliet Balfour, an NHS GP, is joining the startup to help it offer clinically-led remote menopause care.

MPowder, a health startup which sells supplements to help women through menopause.

👉 Lyra Health, Which Provides Therapy For Google And Facebook Employees, Is Facing Concerns Over Privacy And Treatment (Buzzfeed)

When they attempted to find someone else, though, they said a Lyra rep told them in a video call that their issues were too advanced for the company’s care. The rep suggested he seek long-term treatment elsewhere and left him to figure it out on his own.

“I work really hard at Starbucks and I want to get every benefit I possibly can,” Rojas said. “I felt alienated. I felt like I was being cheated.”

➡️ Past a certain type of issue, Lyra is not able to cover members' needs. How do we make sure Alan is plugged in all aspects of therapeutic care and can truly cover the full spectrum (even if it means redirecting)?

When it comes to clinical work, the company puts an emphasis on efficiency. The startup’s in-house therapists are entitled to bonuses based on productivity, two former Lyra staff therapists told BuzzFeed News, which is measured through a range of goals, including symptoms improving over time based on patient surveys.

One of the former therapists, Megha Reddy, said the bonus model can push therapists into “churning out” patients quickly.

As a part-time employee working 20 hours a week at Lyra, Reddy said she was expected to see 12 to 20 patients a week with the goal of having a whole new slate of patients every six to 10 weeks. The financial incentives create the potential for abuse, she said. Her discomfort with the bonus system was her main reason for leaving Lyra.

➡️ I think our business model doesn’t create these incentives but as we scale we need to make sure we are not creating them.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇

Let’s talk about this together on LinkedIn or on Twitter. Have a good week!